Ottawa, Feb. 13, 2026 (GLOBE NEWSWIRE) -- The carbon credit market is growing due to stronger climate regulations, rising adoption of nature-based solutions, advanced carbon tracking technologies, and increased corporate and government efforts to reduce greenhouse gas emissions.

What is the Carbon Credit Market Size in 2026?

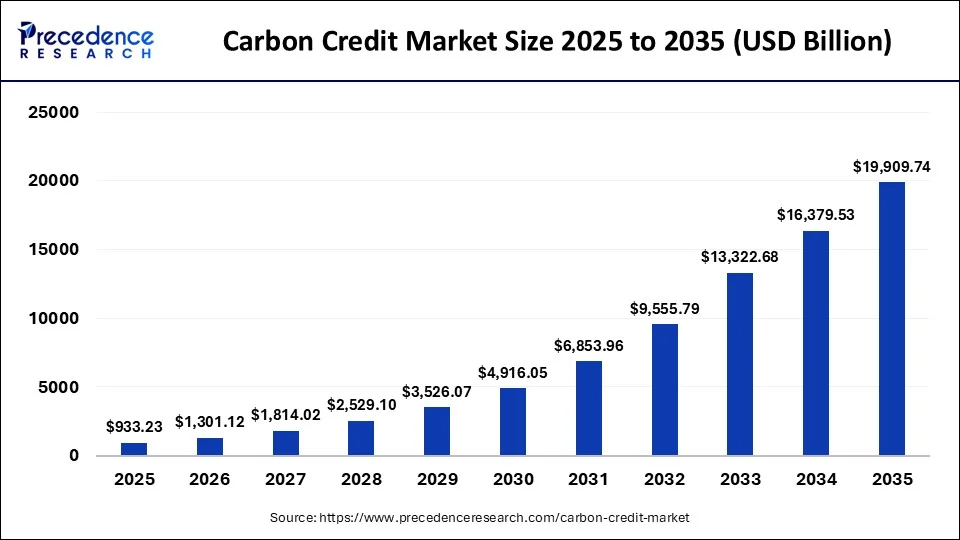

The global carbon credit market size is projected to surpass USD 19,909.74 billion by 2035, increasing from USD 933.23 billion in 2025, accelerating at a CAGR of 37.68% from 2026 to 2035. The company's net-zero targets and the shift towards removal credits drive the market growth.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4396

Carbon Credit Market Key Insights

- In 2025, Europe accounted for the largest share of global market revenue.

- North America is projected to witness the fastest growth during the forecast period, supported by a strong regional CAGR.

- By type, the compliance segment dominated the market, contributing more than 98% of total revenue in 2025.

- By project type, the avoidance/reduction segment generated over 67% of the overall revenue share in 2025.

- By end use, the power segment held a major position, capturing approximately 32% of total market revenue in 2025.

What is Carbon Credit?

The carbon credit market growth is driven by the growing awareness of climate, ambitious goals of sustainability, the presence of cap-and-trade systems, growing investment in carbon capture, government carbon tax policies, and the global climate agreements.

A carbon credit is a certificate that permits a company to emit one tonne of CO2 and other greenhouse gases. It aims to lower the GHG emissions, and credits are based on a cap-and-trade system. The carbon credit includes projects like renewable energy, soil carbon enhancement, CCS technology use, conserving forests, and landfill waste management.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Government Initiatives for Carbon Credits:

- Paris Agreement Article 6.4 (PACM): This UN-supervised centralized global carbon market, which became operational at COP30 in late 2025, allows countries to trade high-integrity carbon credits to meet their climate goals under a unified regulatory framework.

- EU Carbon Border Adjustment Mechanism (CBAM): Starting its definitive phase on January 1, 2026, this policy requires importers of carbon-intensive goods (like steel and cement) to purchase certificates that reflect the carbon price of production, effectively incentivizing cleaner industrial practices globally.

- Indian Carbon Credit Trading Scheme (CCTS): Scheduled for full operational launch by mid-2026, this mandatory national compliance market targets nine high-emission industrial sectors and transitions from energy efficiency to greenhouse gas-based emission caps.

- EU Carbon Removal Certification Framework (CRCF): This initiative provides standardized, EU-wide criteria for certifying carbon removals (such as carbon farming and direct air capture) to ensure transparency and high environmental integrity in both compliance and voluntary markets.

- Australian Safeguard Mechanism: This regulatory framework mandates the country's largest emitters to reduce their emissions intensity, allowing them to use Australian Carbon Credit Units (ACCUs) to meet compliance targets.

- China National Emissions Trading Scheme (ETS): As the world’s largest carbon market, this initiative continues to refine its compliance models for the power and industrial sectors, focusing on stricter oversight of offsets to ensure genuine emission reductions.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4396

What are the Key Trends of the Carbon Credit Market?

- Convergence of Voluntary and Compliance Markets: Government-led frameworks like Article 6 of the Paris Agreement and the EU Carbon Removal Certification Framework (CRCF) are bridging the gap between independent offsets and mandatory state systems. This allows high-quality voluntary credits to be increasingly utilized for national climate targets and international aviation schemes like CORSIA.

- "Flight to Quality" and Pricing Fragmentation: Buyers are moving away from generic, low-cost avoidance credits toward "high-integrity" removals, creating a permanent price gap, where top-rated projects trade at significant premiums. In 2026, market data shows high-quality nature-based removals (like ARR) commanding prices over $35 per ton, while speculative or low-rated projects struggle to find buyers.

- Scaling of Engineered Carbon Removals (CDR): Technology-based solutions like Direct Air Capture (DAC) and biochar are transitioning from expensive pilot phases to becoming bankable infrastructure projects. While these credits still command high prices (ranging from $170 to $500+ per ton), 2026 marks a pivotal year where improved contract structures and clearer performance data are unlocking large-scale private financing.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Carbon Credit Market Opportunity

Corporate Commitments Create Demand for Carbon Credit

The growing government pressure on companies to lower GHG emissions and corporate environmental responsibility increases the adoption of carbon credits. The carbon neutrality goals of corporate firms and strong consumer demand for sustainable products increase the adoption of carbon credits. The corporate brand's commitment to sustainability and increasing corporate investment in external climate projects creates demand for carbon credits.

The strong corporate focus on projects like methane capture and renewable energy increases demand for carbon credits. The corporate firms' focus on net-zero goals and strong ESG credentials increases demand for carbon credits. The corporate commitments create an opportunity for the growth of the carbon credit industry.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Carbon Credit Market Report Coverage

| Report Highlights | Details |

| Market Size in 2025 | USD 933.23 Billion |

| Market Size in 2026 | USD 1,301.12 Billion |

| Market Size by 2035 | USD 19,909.74 Billion |

| Market Growth (2026 – 2035) | 37.68% CAGR |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Project Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

➤ Get the Full Report @ https://www.precedenceresearch.com/carbon-credit-market

Carbon Credit Market Regional Insights

Why Europe Dominates the Carbon Credit Market?

Europe dominated the market in 2025. The presence of the largest market in the region and a strong focus on climate neutrality goals increase the demand for carbon credits. The stricter legal enforcement and the strong focus on green transition increase the adoption of green credit. The well-established power industry and focus on internal sustainability goals increase demand for carbon credits, driving the overall market growth.

The UK Carbon Credit Market Trends

The UK market is expanding steadily, driven by stricter emissions regulations, growing corporate net-zero commitments, and increased participation in both compliance and voluntary offset schemes. Nature-based solutions such as woodland creation and peatland restoration are gaining traction, as companies seek high-integrity, domestically sourced credits with measurable environmental benefits.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/4396

How is North America experiencing the Fastest Growth in the Carbon Credit Industry?

North America is experiencing the fastest growth in the market during the forecast period. The ambitious net-zero goals and the strong presence of the cap-and-trade system increase demand for carbon credits. The growing development of reforestation projects and the increasing investment in carbon removal technologies increase the adoption of carbon credits. The strong focus on the carbon capture solution and the presence of innovative carbon policies support the overall market growth.

Canada Carbon Credit Market Trends

Canada's market is growing rapidly as federal and provincial policies, including carbon pricing regimes and emissions trading systems, drive demand for offsets and create stronger incentives for emitters to reduce greenhouse gases. Domestic compliance markets and voluntary offset programs are expanding, with the voluntary segment showing particularly fast growth as corporations pursue net-zero goals and invest in nature-based credits like reforestation and methane reduction.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Carbon Credit Market Segmentation

Type Insights

Why the Compliance Segment Dominates the Carbon Credit Market?

The compliance segment dominated the market in 2025. The well-developed cap-and-trade systems and the presence of schemes like the EU ETS increase demand for compliance. The growing manufacturing activity and strong presence of the chemical industry increase demand for compliance. The need for legally binding and government mandates increases the adoption of compliance, driving the overall market growth.

Project Type Insights

How did the Avoidance/Reduction Segment hold the Largest Share in the Carbon Credit Market?

The avoidance/reduction segment held the largest revenue share in the market in 2025. The growing development of waste management projects and the expansion of renewable energy plants help market expansion. The strong focus on tackling emissions and increasing focus on preventing deforestation increases the avoidance/reduction of carbon credits. The easy implementation, lower cost, and high scalability of avoidance/reduction support the overall market growth.

End-Use Insights

Which End-Use Segment Dominates the Carbon Credit Market?

The power segment dominated the market in 2025. The high level of emissions in the power industry and the increasing development of large-scale power projects increase demand for carbon credits. The presence of emission trading systems in the power industry and the increasing need for electricity increase demand for carbon credits. The abundance of renewable energy and focus on minimizing energy consumption drive the overall market growth.

✚ Related Topics You May Find Useful:

➡️ Carbon Credit Trading Platform Market: Discover how digital marketplaces are accelerating transparency and liquidity in global carbon trading

➡️ Voluntary Carbon Credit Trading Market: Explore rising corporate sustainability commitments driving voluntary offset investments

➡️ Carbon Capture and Storage Market: Analyze infrastructure expansion as industries race to reduce large-scale emissions

➡️ Carbon Capture and Sequestration Market: Understand technological breakthroughs shaping long-term carbon containment strategies

➡️ Climate Tech Market: See how innovation funding is fueling next-generation solutions for a low-carbon economy

➡️ Carbon Dioxide Removal Market: Track emerging approaches aimed at reversing atmospheric carbon accumulation

➡️ Carbon Footprint Management Market: Discover how enterprises are adopting data-driven tools to measure and reduce emissions

Top Companies in the Carbon Credit Market & Their Offerings:

- 3Degrees Group, Inc.: Provides specialized carbon removal portfolios and global environmental commodity trading to meet corporate net-zero goals.

- Carbon Care Asia Ltd.: Offers carbon asset management and advisory services focused on navigating Asia-Pacific carbon markets.

- CarbonBetter: Sells curated, diversified portfolios of third-party verified carbon credits through an easy-to-use digital platform.

- ClearSky Climate Solutions: Develops and trades high-integrity credits sourced from nature-based solutions and community-focused climate projects.

- EKI Energy Services Limited: Supplies a massive global inventory of credits by managing the full project lifecycle from registration to trading.

- Finite Carbon: Specializes in forest carbon project development, helping landowners monetize conservation through their digital CORE Carbon platform.

- NativeEnergy: Operates a unique "Help Build" model that funds new carbon reduction projects via the advance purchase of future offsets.

- South Pole Group: Manages an extensive global project portfolio and operates specialized buyer clubs to scale high-durability carbon removal technologies.

- Torrent Power Limited: Generates and monetizes carbon credits through its large-scale renewable energy infrastructure and power generation assets.

- WGL Holdings Inc.: Provides carbon offset products to utility customers to help neutralize the greenhouse gas emissions from their natural gas usage.

Recent Developments

- In January 2026, Auri Grow India launched an AI-powered carbon credit agritech platform, CarbonKrishi. The platform focuses on supporting approximately 1 lakh farmers, and estimates the farm-level impact of carbon. (Source: https://www.msn.com)

- In December 2025, the UP Government and IIT-Roorkee collaborated to launch a carbon credit model for farmers in the Saharanpur division. The model focuses on lowering carbon concentration, and farmers get revenue according to their carbon credits. (Source: https://timesofindia.indiatimes.com)

- In September 2025, Canada’s La Caisse and Australian Clean Energy Finance Corporation launched A$250 million carbon credit platform, Meldora. The platform supports the agriculture industry and delivers measurable environmental value. (Source: https://www.asiaasset.com)

Segments Covered in the Report

By Type

- Compliance

- Voluntary

By Project Type

- Avoidance / Reduction Projects

- Removal / Sequestration Projects

- Nature-based

- Technology-based

By End-Use

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4396

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Chem and Materials | Towards FnB | Statifacts | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter