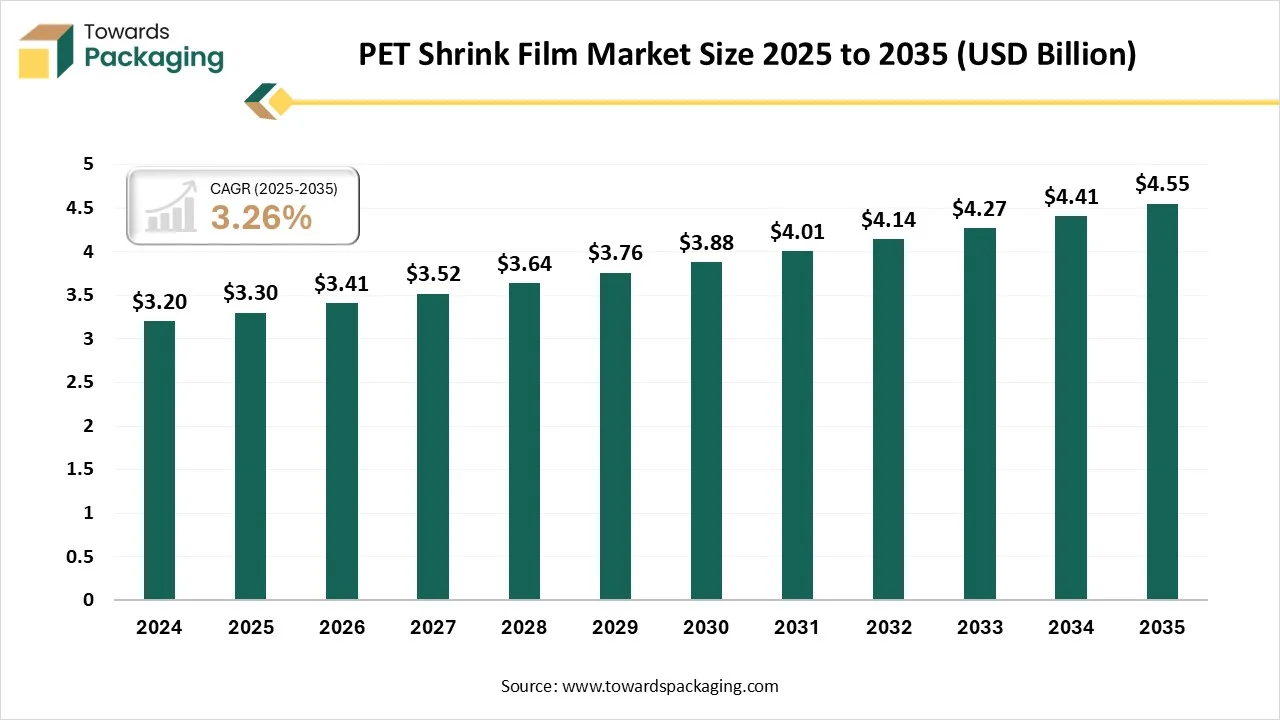

Ottawa, Feb. 02, 2026 (GLOBE NEWSWIRE) -- The global PET shrink film market generated revenue of USD 3.30 billion in 2025, and this figure is projected to grow to USD 4.55 billion in 2035, according to research conducted by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

The PET shrink film market centers on heat-shrinkable polyethylene terephthalate films used for packaging, labeling, and tamper-evident applications across food & beverage, personal care, and industrial sectors. Its popularity stems from high clarity, strength, recyclability, and branding benefits, with sustainability and e-commerce demand driving broader adoption globally.

What is meant by PET Shrink Film?

PET shrink film is a heat-sensitive polyethylene terephthalate plastic film that tightly conforms to products or containers when heat is applied. It is widely used for packaging, labeling, and tamper-evident applications due to its clarity, strength, and durability. The market is driven by rising demand for attractive packaging, brand differentiation, growth in food and beverage consumption, expanding e-commerce, and increasing preference for recyclable and lightweight packaging materials.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5914

Private Industry Investments for PET Shrink Film:

- CCL Industries invested approximately €23 million in a new polyolefin extrusion line in Poland to produce EcoFloat film. This investment, with production starting in early 2022, aims to boost plastic recycling by enabling easy separation of labels from PET bottles during the recycling process.

- Klöckner Pentaplast (KP) committed to a multi-million dollar rPET/PET capacity expansion for North America, adding 15,000 metric tonnes of new capacity. This expansion, operational by Q1 2024, is driven by demand for sustainable options like its SmartCycle recyclable label films and aims to increase the use of post-consumer recycled plastic.

- Berry Global expanded its PET shrink film production capacity across the Asia-Pacific region in February 2024. This expansion was implemented to meet the increasing demand from the beverage industry for sustainable, high-performance packaging solutions.

- Polyplex Corporation's board approved a new BOPET film manufacturing plant in India in January 2025, with an investment of approximately $65 million. This strategic expansion will add 52,400 metric tonnes per annum of capacity to meet the growing global demand for specialty films.

What Are the Latest Key Trends in the PET Shrink Film Market?

1. Sustainability & Recyclable Materials

Brands are shifting from PVC to recyclable PET and rPET shrink films to align with global circular economy goals and regulatory mandates, reducing environmental impact while maintaining performance and recyclability.

2. High-Clarity & Premium Labeling

High-clarity PET films with excellent printability are increasingly used for full-body sleeves, enhancing product visibility and brand appeal, especially in food, beverage, and personal care sectors.

3. E-Commerce & Protective Packaging

Growth in online retail is expanding demand for durable shrink films that secure products during transit, resist punctures, and offer tamper-evident features for better delivery protection.

4. Advanced Material Technology

Innovations like multi-layer extrusion, barrier coatings, and antimicrobial films are improving film strength, shrink performance, and product protection, broadening applications in sensitive sectors such as pharmaceuticals.

5. Digital & Smart Packaging Features

Emerging digital technologies like digital watermarking for smart recycling sortation and enhanced brand engagement are being integrated into PET shrink films to boost recyclability and supply chain traceability.

What is the Potential Growth Rate of the PET Shrink Film Industry?

The PET shrink film industry is driven by rising demand for sustainable, recyclable packaging solutions as brands shift from less eco-friendly materials to PET to meet consumer and regulatory expectations. Growth in food & beverage, pharmaceuticals, and personal care sectors boosts demand for attractive, durable, tamper-evident packaging.

Additionally, e-commerce expansion increases the need for protective films during transit, while technological advancements in film strength, clarity, and printability expand applications and performance.

Regional Analysis:

Who is the leader in the PET Shrink Film Market?

Asia-Pacific dominates the market due to rapid industrialization, strong growth in food & beverage and consumer goods packaging, and expanding e-commerce activities. The region benefits from large manufacturing bases, cost-effective production, rising urban populations, and increasing demand for attractive, lightweight, and recyclable packaging across countries such as China, India, and Southeast Asia.

China PET Shrink Film Market Trends

China dominates the Asia-Pacific market due to its vast manufacturing ecosystem, high packaging demand from food, beverage, and consumer goods industries, and strong export-oriented production. The country benefits from cost-efficient raw material availability, advanced film manufacturing capabilities, large domestic consumption, rapid e-commerce growth, and continuous investments in packaging technology and recycling infrastructure.

How is the Opportunistic is the Rise of North America in the PET Shrink Film Market?

North America’s growth is driven by strong demand for sustainable and recyclable packaging as brands shift toward eco-friendly PET solutions under regulatory pressure. Growth in food, beverage, and ready-to-eat products, paired with expanding e-commerce and protective secondary packaging needs, boosts shrink film adoption. Advanced manufacturing technology, innovation in high-performance films, and a focus on tamper-evident and moisture-resistant solutions further accelerate regional market expansion.

U.S. PET Shrink Film Market Trends

The U.S. dominates the North American market due to strong demand from food, beverage, and consumer goods packaging, widespread e-commerce growth, and a shift toward sustainable, recyclable materials. Advanced manufacturing infrastructure, innovation in high-clarity and high-performance films, and strict packaging standards further strengthen its leadership in the region.

More Insights of Towards Packaging:

- Grab and Go Containers Market Size, Trends and Competitive Landscape (2026–2035)

- Translucent Cosmetic Packaging Solutions Market Size and Segments Outlook (2026–2035)

- APET-Based Thermoformed Trays Market Size, Trends and Competitive Landscape (2026–2035)

- Packaging Materials Market Size, Trends and Segments (2026–2035)

- Ceramic Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Cross-linked Polyethylene Market Size, Trends and Segments (2026–2035)

- Plantable Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Cold Form Blister Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Nordic Beverage Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Pre-press for Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Biohazard Bags Market Size, Share, Trends, and Forecast Analysis 2035

- Air Cushion Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Polycarbonate Sheet Market Trends and Global Production Volumes for 2026-2035

- Packaging Wax Market Size, Trends and Regional Analysis (2026–2035)

- Biodegradable Plastic Films Market Size, Trends and Regional Analysis (2026–2035)

- Wafer Level Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Single Dose Packaging Market Size and Segments Outlook (2026–2035)

- Molded Pulp Packaging Market Size and Segments Outlook (2026–2035)

- Consumer Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Paper Packaging Materials Market Size and Segments Outlook (2026–2035)

Segment Outlook

Material Type Insights

What made the PET-G shrink film Segment Dominant in the PET Shrink Film Market?

The PET-G shrink film segment stands out due to its superior toughness and impact resistance, making it suitable for heavier or irregularly shaped products. PETG also offers better formability and lower shrink temperature, improving processing efficiency. These properties make it preferred for complex shapes, protective packaging, and applications where enhanced durability is needed.

The recycled PET (R-PET) shrink film segment is fastest growing due to increasing consumer and regulatory demand for sustainable packaging and reduced plastic waste. Brands prioritize eco‑friendly, circular solutions, while advancements in recycling technologies improve film quality. This drives adoption across food, beverage, and consumer goods industries seeking recyclable, lower‑carbon alternatives to traditional PET films.

Product Form Insights

How the Shrink Sleeves Machines Dominated the PET Shrink Film Market?

The shrink sleeves machines segment dominates the market because it enables efficient, high-speed packaging, precise film application, and consistent product appearance. Its compatibility with automated production lines, ability to reduce labor costs, and support for large-scale operations make it the preferred choice for food, beverage, and consumer goods industries.

The tamper-evident bands segment is the fastest-growing in the market due to rising consumer demand for product safety and authenticity. It provides visible evidence of tampering, enhancing trust in food, beverage, and pharmaceutical products. Increasing regulatory requirements and brand focus on secure, reliable packaging further drive adoption across industries.

Application Insights

What made the Labeling Segment Dominant in the PET Shrink Film Market?

The labeling segment dominates the market because it enables full-body, high-clarity labels that enhance product visibility and brand appeal. PET shrink films offer excellent printability, durability, and conformability to various container shapes, making them ideal for food, beverage, and personal care products. The segment benefits from rising demand for attractive, tamper-evident, and premium packaging solutions.

The tamper-evident seals segment is the fastest-growing application in the market due to increasing consumer focus on product safety and authenticity. It provides visible tamper protection, builds trust, and meets regulatory requirements, driving adoption across food, beverage, pharmaceutical, and personal care industries seeking secure and reliable packaging solutions.

End-Use Industry Insights

Which Factors Make the Food & Beverage Segment the Dominant Segment in the Market?

The food & beverage segment dominates the market because it requires durable, tamper-evident, and visually appealing packaging to protect products and enhance shelf presentation. PET films offer excellent clarity, printability, and barrier properties, making them ideal for bottles, cans, and containers. Growing demand for packaged and ready-to-eat products further drives adoption in this sector.

The personal care & cosmetics segment is the fastest-growing in the market due to rising demand for premium, visually appealing, and tamper-evident packaging. PET films provide excellent clarity, printability, and conformability, allowing brands to enhance product presentation, ensure safety, and meet consumer expectations for high-quality, secure, and attractive packaging solutions.

Recent Breakthroughs in the PET Shrink Film Industry

- In November 2025, Labelexpo Asia 2025 featured advanced shrink film technologies and sustainable packaging solutions from multiple exhibitors. These emphasize innovations in material science and application versatility in the PET and flexible packaging sectors.

- In June 2025, Taghleef Industries unveiled Shape360 TDSW, a white, floatable polyolefin shrink sleeve film designed to improve recyclability and printing performance while supporting bottle-to-bottle PET recycling. This innovation expands sustainable label options and enhances separation during recycling.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Companies in the Global PET Shrink Film Market & Their Offerings:

Tier 1:

- Sigma Plastics Group: Manufactures high-durability industrial shrink and stretch films for heavy-duty bundling and case packaging.

- Sealed Air: Provides high-performance CRYOVAC® polyolefin shrink films with a focus on high-clarity display and post-consumer recycled content.

- Cosmo Films Limited: Produces specialized high-shrink PET-G films designed for full-body sleeves on complex, contoured containers.

- Polyplex: Supplies high-clarity PET shrink film grades used extensively for label printing and high-contour sleeve applications globally.

- Jindal Poly Films Limited: Offers a diverse range of specialty PET films, including ultra-clear and chemically treated variants for the labeling industry.

- Uflex Limited: Develops sustainable PET films, including the Asclepius range made from up to 100% recycled PET (PCR) resin.

- Fuji Seal International: Leads the market in integrated shrink sleeve solutions, specializing in ultra-thin and recyclable films for the beverage sector.

- CCL Industries: Features EcoFloat™ and EcoCrys™ shrink labels engineered to be fully compatible with and separable during PET recycling streams.

- Klockner Pentaplast (KP): Markets the Pentalabel® series, offering high-performance films like eklipse® for light protection and SmartCycle® for circularity.

Tier 2:

- Bonset America / Bonset Group

- SKC Films

- Polyplex Corporation

- UPM Raflatac

- Klöckner Pentaplast (KP Films)

- DOW, Berry Global

- Amcor plc

- FlexFilms (UFlex)

- Toray Plastics

- Huhtamaki

- Avery Dennison

Segment Covered in the Report

By Material Type

- PET-G Shrink Film

- Regular PET Shrink Film

- Recycled PET (R-PET) Shrink Film

- PET-G / R-PET Hybrid

By Product Form

- Shrink Sleeves

- Shrink Wraps / Bundling Films

- Tamper-Evident Bands

- Preform Shrink Labels

By Application

- Labeling

- Packaging & Bundling

- Tamper-Evident Seals

- Multi-Pack Collation

- Promotional Sleeves

By End-Use Industry

- Food & Beverage

- Personal Care & Cosmetics

- Household Chemicals

- Pharmaceuticals

- Industrial Products

- Dairy & Juice

- Confectionery

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5914

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- PET Bottle Blow Molding Machine Market Size and Segments Outlook (2026–2035)

- Spoon In Lid Packaging Market Size and Segments Outlook (2026–2035)

- Food Cans Market Size, Trends and Segments (2026–2035)

- Tamper Proof Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Polyolefin Shrink Sleeve Labels Market Size, Trends and Regional Analysis (2026–2035)

- Sports Cap Closures Market Size, Trends and Competitive Landscape (2026–2035)

- Premix Packaging Machine Market Size, Trends and Regional Analysis (2026–2035)

- Bag-in-box Packaging Market Analysis, Demand, and Growth Rate Forecast 2035

- Wrap-Around Cartoning Machines Market Size, Trends and Regional Analysis (2026–2035)

- Cryogenic Labels Market Size, Trends and Competitive Landscape (2026–2035)

- Medical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Automotive Plastic Compounding Market Size, Trends and Regional Analysis (2026–2035)

- Multi-med Adherence Packaging Market Size, Trends and Segments (2026–2035)

- Flexible Polyurethane Foam Market Size and Segments Outlook (2026–2035)

- Sealing and Strapping Packaging Tapes Market Size and Segments Outlook (2026–2035)

- Kraft Paper Bag Market Size, Trends and Regional Analysis (2026–2035)

- Pharma Blister Packaging Machines Market Size, Trends and Segments (2026–2035)

- Recycled Glass Market Size and Segments Outlook (2026–2035)

- Multilayer Flexible Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Testing Services Market Size and Segments Outlook (2026–2035)